Bitcoin - a Love and Hate Story

I don’t remember the date I first encountered “bitcoin.” I have vague memories of my Facebook wall when a friend posted about 1 BTC going above 1 USD. I even googled it then, but I didn’t understand and ditched it. Now, of course, I wish I hadn’t. Years later, the price jumped 5000x.

I take away three key learnings from the above story:

- If I don’t understand something, it doesn’t mean that it cannot become important.

- The subjective importance of something is dependent on its measurable value.

- The best investment hypothetically could be something you forget about.

The following article revolves around these three learnings in trying to understand Bitcoin.

Over the years, I have developed many arguments for and against it, just like I have many ideas for and against the US dollar, Facebook, Donald Trump, Joe Biden, or veganism. I undoubtedly see potential social growth in Bitcoin, but I also see potential social doom.

So I don’t intend to prove that Bitcoin is all good or bad. I intend to help you understand it better.

The facts

When people refer to Bitcoin, they typically refer to one of two things with the same word, which is confusing. Either they refer to the Bitcoin network, or they refer to the Bitcoin token. Note: They can also refer to the Bitcoin protocol.

The Bitcoin network

It’s a set of computers (called Bitcoin nodes) running a piece of software called the Bitcoin Core. These machines (nodes) communicate with each other in a peer-to-peer way. Each node sends messages to and receives messages from other nodes over the internet.

They are communicating with each other to process and store a ledger of transactions between participants immutably. So that is, none of the nodes should be able to change a transaction in the past and fool everyone else.

Each node stores the ledger (i.e., distributed ledger). Most importantly, there is no central machine standing above all that can tell the network what to keep or process or what is right or wrong. Instead, all nodes are treated equally. They are decentralized.

Conversely, they need to agree with each other about the current state of the ledger. Through communication, they need to form a stable consensus (i.e., consensus algorithm).

Roughly speaking, the more independent nodes are in the network, the more resilient the network becomes. Of course, one can turn off a node, but that won’t stop the network from operating.

We can look at the Bitcoin network as a living, higher-order organism. An ever-changing set of cells that are constantly in communication with each other, and unless you would kill all the cells, the organism can survive and serve its purpose.

I intentionally oversimplified the above description of the Bitcoin network. However, under the hood, it is a fascinating and complex technological innovation utilizing many computer scientific and mathematical pieces beyond this article’s scope.

A sidenote about value

Please keep in mind that the above facts don’t say anything about money or monetary value. Neither they say anything about the Bitcoin token itself or its perceived value. Instead, these facts are a sheer description of a system, a network of computers, and what they can achieve together to resiliently process, store, and make information immutable without a central controlling entity.

I firmly believe that the notion of value is inherently an ethically-loaded subjective concept. I believe that there is no such thing as objective value. Apples, oranges and centrally-issued money is subjectively valued. Therefore I don’t intend to make a case for the objective value of the Bitcoin network, because such thing does not exist in my opinion. However things become valuable to some people and if there isd a constantly growing number of people to whom this thing becomes valuable, then some people might confuse that with objective value.

On a personal note about the value of the Bitcoin network, I on my own find it valuable that I don’t have to trust anyone, in particular, to reliably and immutably store transactions in a ledger. Still, it just works.

I leave it up to you to decide if this could be valuable to you or not.

The Bitcoin token

This is where the controversies begin.

The Bitcoin token is a very simple concept, but because of its function (feature) to facilitate value-transactions, everyone immediately wants to measure its value and associate a particular exchange rate with it (e.g. 1 BTC = 40000 USD).

I know, it sounds counterintuitive, but for the moment, please don’t think about the Bitcoin token as something that has an exchange rate to US dollars. Rather just think about it as Monopoly money, which is extremely valuable in the game of Monopoly, but it has nothing to do with our real-world financial system. It will help.

But first, let’s take two steps back and first understand how tokens can represent value, and second what these value-transactions are, that are processed and stored by the Bitcoin network.

The notion of value and a token as a representation of value

A value-transaction is an exchange of value between parties. As mentioned above I firmly believe that there is no such thing as “objective value”. However, in the case of a value-transaction, all parties must attribute value to the things exchanged, otherwise, the transaction simply won’t happen.

In a transaction, value is exchanged to another value. In case a good is exchanged to another good, they have an exchange rate (e.g. 2 apples equals 1 orange). In a perfect market this exchange rate becomes stable, meaning that 2 apples will always equal to 1 orange. If this would hold, then any good’s value could be measured by another good (e.g. 1 watermelon is exactly 13.5643 apples). There are few problems with this:

- In reality exchange rates are not stable (Merchant A could sell an orange for 2 apples; Merchant B could sell an orange for 2.5 apples)

- How the heck would all the people agree to use “apples” as a measure?

The first point is just nature. There is nothing one can do with that. This is how our lives work. Merchants may determine the “price” of a good differently from each other.

The second issue can be resolved though.

It can either be resolved by a consensus (i.e. people agree that “apples” are the ultimate measure) or by force (i.e. king, government, central bank, etc. enforce that gold coins are the measure).

The reason why historically the second one is more likely to happen is because of two things:

-

Force is force.

-

It effectively creates (!!!) instant credit to spend. For example a king could decide to create a new token (e.g. gold coin), pay soldiers with it, force people to accept it and force them to pay taxes in it. Effectively this creates immediate markets (!!!) for the created credit.

Because of the tendency of humans to organize themselves hierarchically, this scenario is extremely likely. Even the likes of delegative democracy authorizes central entities (central banks specifically) to act accordingly so.

A key interesting learning from this is that it is possible to create a token as a representation of value, if:

- The one that creates it is credible.

- The token enables the creation of markets.

- Increasing amount of humans accept it for various reasons.

- It is not crushed by power.

An important note though is that the created token in itself is just a representation of value and not value itself. It is a genius technical construct/product, that enables more convenient and effective transactions, funds growth, so more actually perceived value can be created and many other things.

It’s also important to mention that the aforementioned description doesn’t say anything about the stability of the exchange rate of the created token over time. It is a significant controlling challenge to ensure the longevity of the token. For example if the growth rate of perceived value is not matched well with the creation rate of the token, then it can lead to stability issues.

Token v2

It’s easy to see from the above that central bank currencies (i.e. money), for example the US dollar are tokens. I would call them the first version of tokens. Even though they are not the first iteration in the history of humanity, but essentially their creation is by force and not consensus.

The problem with centrally created tokens is that their creator has unmatched controlling power over them and therefore it is mainly a tool for them to keep their power. So the big challenge is whether we can fix this design issue and take out the wrong incentive from the system.

What I mean is that the big design question is:

Can we create value representing tokens by consensus and not by force?

The Bitcoin token is a heck of a proposition to solve this problem.

Value-transactions and the risk transformation

We are pretty much used to version 1 tokens (e.g. US dollar). So it’s easy to illustrate the functional aspect of Bitcoin with the following example.

Let’s assume that Person A would like to send $100 (worth of value) to Person B and they are not in the same room. Here are a few possible scenarios:

- Person A could send a letter via mail with a $100 note enclosed, trusting the post they’re going to take it to Person B.

- Person A could transfer the money by wire (e.g. from Person A’s bank account to Person B’s bank account), trusting the banks, Western Union, Transferwise, or any other financial services company.

In each of these cases there are three types of core risks that arise.

- Third-party transfer Risk. They need to trust particular third-party entities (the post, bank(s), financial services companies) with the transfer.

- Stability Risk. It might not be trivial, but technically the actual value representation of the dollar token can diminish due to inflation and/or bad monetary control.

- “Force” Risk. The actual central power may decide to forcefully ban this transaction (e.g. put People A and B into jail for example).

Alternatively Person A and B could use the Bitcoin network.

Person A could give $100 to one of the node operators to get Bitcoin tokens in exchange. Then Person A could send those Bitcoin tokens to Person B by creating a transaction on the Bitcoin network. Person B could sell back (if she wants to) the received tokens to one of the node operators and receive the $100.

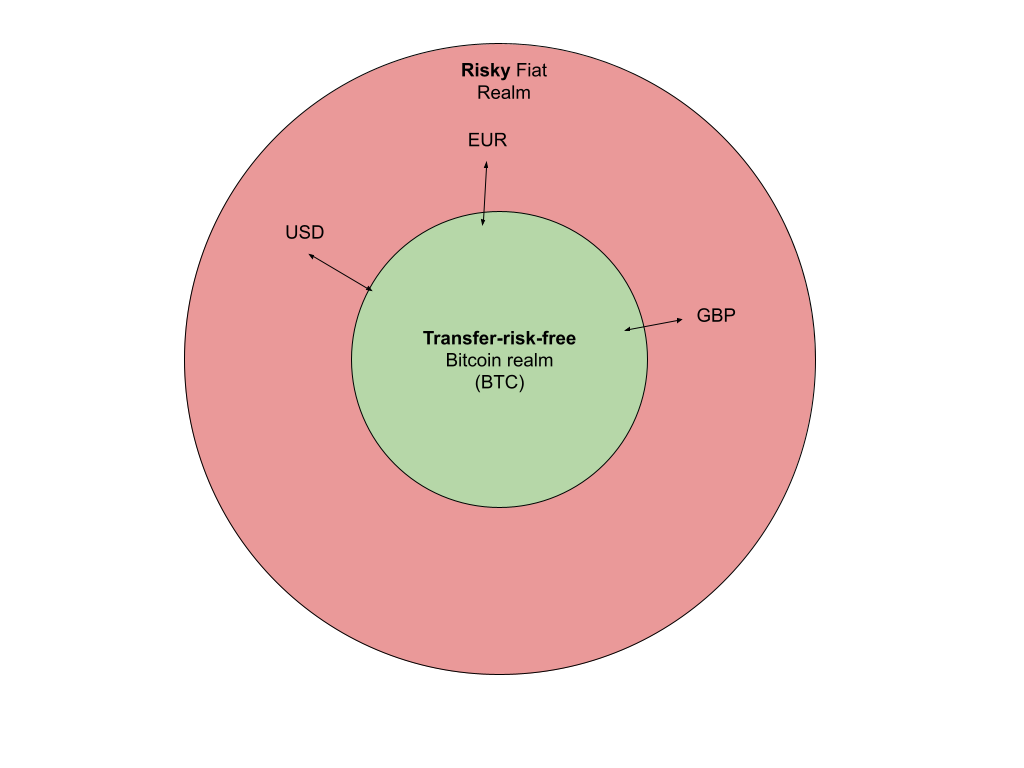

In this scenario, instead of trusting third parties with the transfer, once the $100 is exchanged, they don’t need to trust anyone in particular with the exchange. So that’s a win. This risk is effectively eliminated. However there are still three risks present.

We could say that the risks are transformed. We got three new ones:

- Stability Risk. The value representation of the Bitcoin token (BTC) can diminish due to various reasons (e.g. speculation, inflation, etc.)

- Third-party Transfer Risk. USD to BTC transfer to exchange risk.

- “Force” Risk. The central power may decide to forcefully ban Bitcoin transactions (e.g. put people into jail)

However from a system perspective we could say that inside the Bitcoin realm we don’t face the Transfer Risk. We only face it only while outside of, getting into and getting outside of it.

So what about Stability Risk and Force Risk?

Force Risk is definitely there and it’s an extremely hard one to cope with. It is usually called Regulatory Risk. Since we are living under the umbrella of government authority, it is really hard to escape it.

Stability Risk is slightly different. The stability of BTC is dependent on just as many factors as any fiat currency, but it is not dependent on the central banks monetary control. In fact the monetary control of BTC is implemented in an algorithm inside the Bitcoin Core software. This means that we lose the flexibility of a “fast-acting” central bank committee, but we also gain stability in behaviour by the hard-coded algorithm.

The Bitoin inflation control

For each validated Bitcoin block some new BTC is created automatically and given to the BTC miner. The amount of new BTC created is halved every four year. This is a super simple decreasing inflation model and it cannot be changed by anyone in particular. It is a decentralized behaviour.

Summary of the Bitcoin token

Hopefully from all the above it becomes clear that the Bitcoin Token can represent value. In fact it is an iteration of value representation that we call centrally-issued currency or fiat money, with the proposition to limit the influence of the delegated authority, preventing any potential misconduct. It is also clear that inside the Bitcoin realm the risks of value representation are somewhat mitigated, however not completely eliminated.

Is it money?

All the things noted above don’t necessarily need to result in Bitcoin becoming the “new” money. There are other natural tokens in human history that represent value and based on consensus. Gold and precious metals are good examples of that. At the same time they are not created by us, but by nature.

And this is where we circle back to my comment about the Bitcoin Network as a living, higher-order organism. Bitcoin Tokens are not created by humans. Bitcoin Tokens are created by the Bitcoin Network, that from this perspective can perhaps better be described as a natural phenomenon, than a human one.

Considering all this Bitcoin tokens could safely take over the role of gold consensually as value representing assets, without messing with the concept of social governance and elevating the risk of regulation.

Conclusion

All the aforementioned notes stir up our ingrained notion of how governance is necessarily combined with the control of money. Bitcoin is not simply a technical innovation, it is an ideological, political statement, that bites into the very nature of social organization related beliefs. It is controversial. It induces primal excitment and at the same time primal fear.

I leave it to you to judge it’s importance to you.

However, I cannot stress enough, that Bitcoin should be better observed and considered more as a living organism, rather than a sheer construct of humanity.

Good luck fellas!

Laz